Maintaining strong profit margins is more critical than ever, as retailers navigate a rapidly shifting environment shaped by rising costs, evolving customer expectations, and new digital competitors. In this guide you’ll learn:

- Margin & Markup Fundamentals: Gain an understanding of essential concepts and up-to-date best practices for calculating margins and markups, so you can set prices that support your business goals in 2025 and beyond.

- Profitability Strategies: Discover actionable tips for optimizing your product mix, tracking key metrics, and using data to maximize your store’s revenue.

- Today’s Top Tools & Resources: Explore new possibilities with automation and AI, the latest retail software, and smart sourcing opportunities that can help you take your profitability to the next level.

Whether you operate a brick-and-mortar store or an online empire (or both), your ability to curate the right product mix and price profitably is essential for your success. To ensure sustained profitability, it’s crucial to identify products that offer not just high retail markups but also larger-than-average profit margins.

Explore 1800+ vendors ready to bring your 2025 margins to new heights at ASD Market Week in August!

When you’re curating your product selection, it’s all about the delicate balance between price and profit, closely aligned with consumer trends. You understand that staying on top of the latest trends drives sales, but you also realize that it’s your top-selling items that create loyal customer relationships, with 20% of your products typically accounting for 80% of your sales.

As a savvy buyer, you know it’s not just about selecting popular products; it’s about curating a merchandise mix that thrives year-round. Your product assortment becomes an intricate matrix, especially when you consider holidays and personal celebration dates. To ensure sustained profitability, it’s crucial to identify products that offer not just high retail markups but also larger-than-average profit margins.”

But before we get into how you can make that all happen, let’s clarify a few key terms:

Retail Pricing Terminology

These terms might seem obvious, but they have a huge impact on your calculations — so it’s important to make sure you know exactly what they mean:

- Price: The amount you charge customers for your products.

- Revenue: How much you make from those goods.

- Cost/Cost of Goods Sold (COGS): The total cost to acquire or produce your inventory, including materials and direct labor.

- Gross Profit: What remains after subtracting COGS from your revenue.

Now that we’ve covered these, let’s move onto better understanding margins and markups.

What Are Retail Margins?

Margins reflect the percentage of each sale that is profit, after accounting for the cost of goods.

For example, if you buy a product for $100 and sell it for $200, your gross profit is $100 and your margin is 50%.

Many retailers see that 50% as a benchmark for strong margins, while others aim to gain higher margins to help them make more money and cover their costs while increasing their profit. However, if you set your prices too high to increase your margins, other competitors can set prices lower and steal your customers.

What Are Retail Markups?

Markups are different than margins. A markup shows the percentage of profit, meaning it shows how much more you make from the selling price less than the amount the item costs you. Like a margin, you start finding a markup with your gross profit (revenue minus COGS). Here’s an example:

You sell a self-care kit for $175. The self-care kit costs you $100. That means the markup is 75% (you sold the kit for 75 percent more than the amount you paid for it).

The higher the markup, the more revenue you’re making. Markups are especially useful when setting initial prices or negotiating bulk purchases.

Margin vs. Markup: When to Use Each

Both margin and markup are essential metrics, but they serve different purposes. Use markup to ensure you’re covering costs and generating profit on each sale. Use margin to evaluate overall

Finding Profitability in Your Product Pricing

Your margins and markups are the foundation of your store’s profitability. To make that foundation as strong as possible, start by revisiting your profit goals, then align your buying and inventory decisions accordingly. Ask yourself:

- What are my profit targets for the remainder of 2025 and 2026?

- How do my current product margins support these goals?

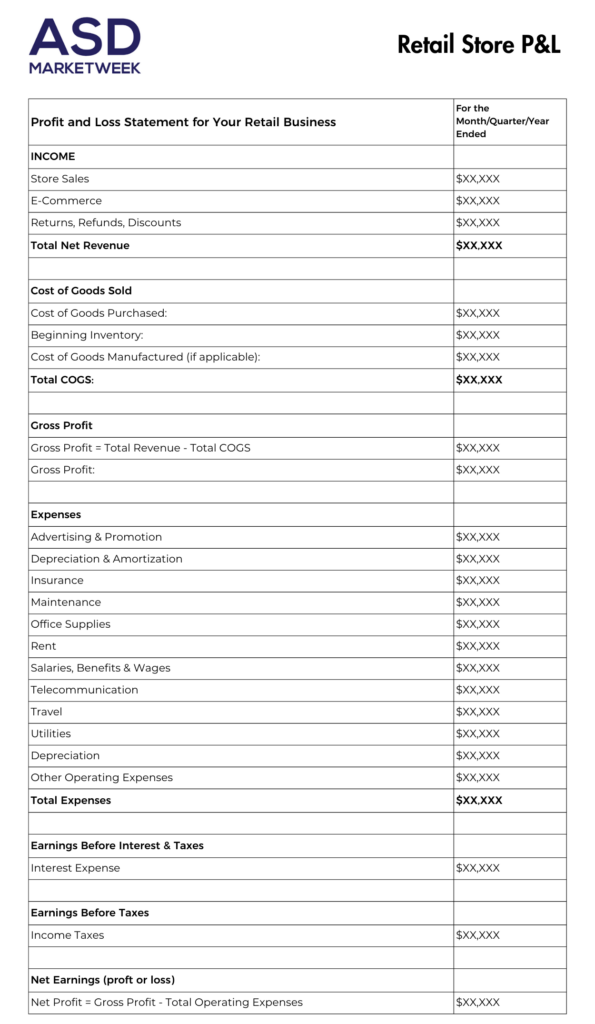

Our free profit and loss sheet can help you establish your goal if you need to look at all your costs and identify areas for improvement. In your inventory, you are most likely going to have: are most likely going to have:

- Low-profit goods: Items that bring people to your store and/or items frequently purchased in volume.

- Medium-profit goods: Consistent sellers with margins that aren’t the highest or the lowest.

- High-profit goods: Items that sell at good margins or high markups, but their sales may be seasonal or trend-based.

Sales patterns for low, medium, and high-margin goods can differ widely — some high-margin items sell steadily, while certain lower-margin products move quickly and help drive store traffic and additional purchases. To capitalize on these trends, accurate inventory and sales tracking is essential; it lets you see what’s selling, what’s attracting customers, and how buying habits differ in-store versus online. With this data, you can strategically price merchandise using margins and markups to maximize profitability.

Grab a Copy of Our Retail P&L for Your Business

Tools & Strategies for Retailers in 2025

Staying profitable in 2025 means embracing a mix of smart tools, data-driven strategies, and in-person opportunities to discover the right high-margin products for your business.

- Leverage Advanced Retail Software: Platforms like Shopify, Square, and Clover now offer robust inventory management, real-time sales analytics, and seamless ecommerce integration — helping you spot trends, manage costs, and optimize pricing across channels.

- Adopt AI and Automation: AI-powered tools can provide insights into your customer’ behavior, predict what they’ll want next, and automate inventory management, making it easier to anticipate trends and streamline operations.

- Offer Flexible Payment Options: Implementing solutions like buy now, pay later (BNPL) can increase average order size, help move those higher-ticket items, and attract budget-conscious shoppers.

- Data-Driven Merchandising: Regularly review your sales data to identify top-performing products, effective loss leaders, and bundling opportunities that drive both traffic and profit.

- Source Smarter: Rising costs mean it’s especially important to choose your buying trips wisely. Events like ASD Market Week provide a unique opportunity to connect with over 1,800 vendors across 19+ categories, discover trending products, and negotiate deals that can deliver margins up to 300%. By seeing products in person, you’ll eliminate costly surprises and build relationships with vendors that are especially important when navigating changes to global supply chains.

By mastering your finances as a retailer, understanding how to price goods, leveraging technology, and taking advantage of in-person sourcing opportunities, you’ll be well-positioned to maximize margins and drive sustained growth in a rapidly evolving market.

0 Comments